How Long Can You Finance an Exotic Car?

Exotic cars are every car lover’s dream. Their impeccable design and performance attract everyone’s attention. But have you considered turning this dream into reality? If you’ve ever thought about getting your own exotic car, you must be left wondering about getting a loan. But, as you’ll need to borrow a large sum of money, how long can you finance an exotic car?

Stay with us as we take a look at what it takes to own your dream car. In addition, we will see all the financing options available to you.

How long can you finance an exotic car?

So, how long can you finance an exotic car? Usually, the exotic loan can be from 2 to 7 years, but some lenders give a term of up to 12 years. However, such financing depends on many other factors.

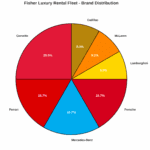

Source: fisherluxuryrental.com

Factors Affecting Financing Terms

In order to own the exotic car you’ve always wanted, you need to pay attention to several factors. The following factors will help you plan your finances and choose the best lender.

Good Credit score

Before you decide to buy a supercar, you should consider your credit score. Usually, lenders have no problem with customers who have an excellent credit score. A good credit score is considered 740 and above. In addition to quicker loan approval, these customers will also receive a lower interest rate.

But if you have a low or average credit score, chances are you’ll have to pay a larger down payment and might have a hard time getting approved. In addition, take into account that the interest rate will also be higher. In such cases, the lender may also review your loan history to ensure you will repay the amount successfully. The lender can check your income and additional funds at your disposal.

Interest rate

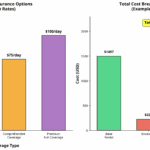

The interest rate is an important factor that plays a role in determining the monthly installment. Regarding the interest rate, consider all the options available to you regarding lenders.

Sometimes, these interest rates can go up to 10%, significantly affecting your budget. In addition, make sure that your credit score is 740 and above to get a more favorable interest rate. If you cannot determine the monthly installment, you can use the Auto Loans Calculator to clarify things for you.

Funding sources

Since it is a large amount of money, you should also pay attention to the sources of financing. Below, we have suggested several options that you can consider.

- Dealership financing– Several car dealerships can help customers who want to buy an exotic vehicle. If you opt for this option, you can get good deals like low APRs.

- Online lenders– A positive thing about online lending is that such lenders do not have their branches like other lenders. Therefore, you can get a good deal, which means lower interest rates. However, remember that such lenders have stricter criteria for approving auto loans.

- Bank loans– Banks may offer you special loans that are intended for the purchase of exotic cars. Accordingly, you can find loans on favorable terms and lower interest rates.

Loan Terms for Exotic Cars

Suppose you have chosen your ideal exotic car. The next step is to consider the terms offered by the lender. As we said, the lender checks your credit score, affecting whether you get a higher interest rate or have to pay a larger down payment.

Also, if you are looking for a loan for 12 years, you may have to pay a higher interest rate because of the risk in which the lender is placed.

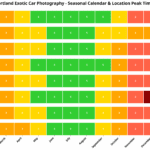

Source: fisherluxuryrental.com

Leasing an Exotic Car

If you want to enjoy the advantages of an exotic car and are not in a financial position, consider leasing an exotic car. With leasing, you pay for using the car for a longer period, usually 2 to 3 years. Unlike buying, leasing is a more cost-effective option, and you will avoid the additional costs of buying a new car. After the leasing has passed, you may ask for the purchase of the car.

Types of car leasing

Before you decide to lease a vehicle, you should familiarize yourself with the various types of leasing. In this section, we will present the most common types of car leasing:

Closed-end lease

Closed-end lease, better known as a walk-away lease, is the most common. If you decide on this type of leasing, you make regular monthly payments during the leasing period.

After the lease ends, you return the car without paying for depreciation or buying it. But expect to pay extra charges if you’ve exceeded the mileage allowance or returned the car in poor condition.

Open-end leases

Commercial companies mostly use open-end leases and offer more flexibility than closed-end leases. With such leasing, the lessee covers the difference between the vehicle’s residual value and the vehicle’s value on the market at the end of the leasing. In addition, unlike closed-end leases, this type of leasing has no mileage limit.

Single-payment leases

Also known as one-pay leaves, single-payment leases allow you to pay up-front for the full lease amount for the entire lease period. If you opt for this type of leasing, you will avoid monthly payments.

Also, a positive thing about this type of leasing is that you can negotiate with the lessee for lower fees. That way, you can save costs you would have paid if you had opted for a closed-end lease.

Subsidized leases

Showrooms or car manufacturers usually offer this type of leasing. A characteristic of subsidized leases is that you will have lower costs or monthly installments. But if you decide on this type of lease, remember that lessees have stricter rules.

Pros and cons of car leasing

| Pros | Cons |

| Lower upfront installment and lower scheduled installments | Most lessees require having a mileage limit |

| Access to newer car models | |

| Option to buy the car after the end of the lease | |

| Possibility of tax reductions |

Conclusion

No matter which financing option you decide on, pay attention to all the factors when buying an exotic car. If you decide on a loan, carefully consider the conditions the lender offers. In addition, take into account your credit score, the budget available to you, and the exotic car loan length. But if you cannot buy, you can choose leasing as a more affordable option.

Now that you know how long you can finance an exotic car, it’s time to make a detailed plan to buy your dream car.